A taxpayer identification number or TIN is issued by the Bureau of Internal Revenue for employees in the public and private sector. This allows efficient transaction for individuals and businesses who may otherwise have similar names that causes confusion and possibly result in wrong identification.

Filipinos based abroad whose income is purely sourced outside of the Philippines are exempt from filing Income Tax Returns, according to Section 23 of the Tax Code. However, they must have prior registration at Philippine Overseas Employment Administration and holding valid Overseas Employment Certificate to avail of exemption from taxes, such as travel tax and airport fees as well as documentary stamp tax on remittances.

Likewise, even though they are based overseas, foreign-based Filipino citizens may occasionally have transactions taking place in the Philippines such as operating their established businesses in the country, or investing in the Philippine stock market. Hence, there is a need to apply for TIN to enable the government to collect tax dues.

How OFWs and Overseas-based Filipinos Can Apply for TIN

Document requirements:

- Birth certificate or any valid identification showing name, address, and birth date; or

- Passport with visa; or

- Employment contract

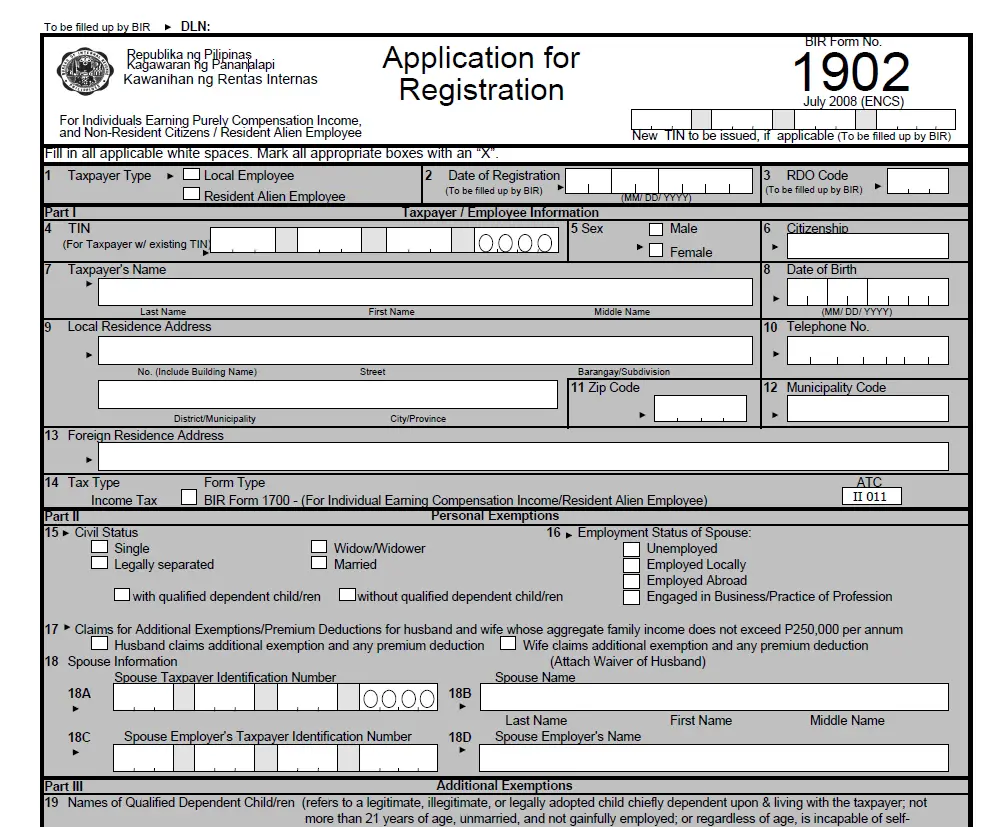

- BIR Form 1902 (download form here) – Fill out this application for registration for individuals earning purely compensation income and non-resident citizens/OFWs/Seafarers earning purely foreign-sourced income.

Procedure

After completely filling out BIR Form 1902, submit this document, along with other documentary requirements listed above to the Regional District Office of BIR in the Philippines having jurisdiction over the place of residence of the applicant.