If you wish to engage in a business on your own and not in a partnership or corporation, you may apply the business as a sole proprietor. This type of business is defined as owned and managed by an individual.

5 Benefits of a Sole Proprietor Business

- It requires minimal amount of capital money, as small businesses and startups.

- It is easier to set up and register, requiring less documentation and requirements.

- Lower costs in acquiring government permits and licenses.

- Sole proprietor takes full control of the business.

- Sole proprietor gets all the profits.

4 Risks and Disadvantages of a Sole Proprietor Business

- Sole proprietor takes all responsibility and liabilities of the business

- The owner solely suffers the losses if the business falters

- Without partners or employees, sole proprietor running the business alone may lead to exhaustion.

- Loan creditors, government agencies can run after owner’s assets since business is directly associated to an individual only.

How to Apply For Sole Proprietor Business in the Philippines

Requirements

- Certificate of Business Name Registration from the Department of Trade and Industry

- Barangay/Municipality/Regional clearance depending on scope of business

- Business permit from mayor’s office

- Business Tax Identification Number

Procedure

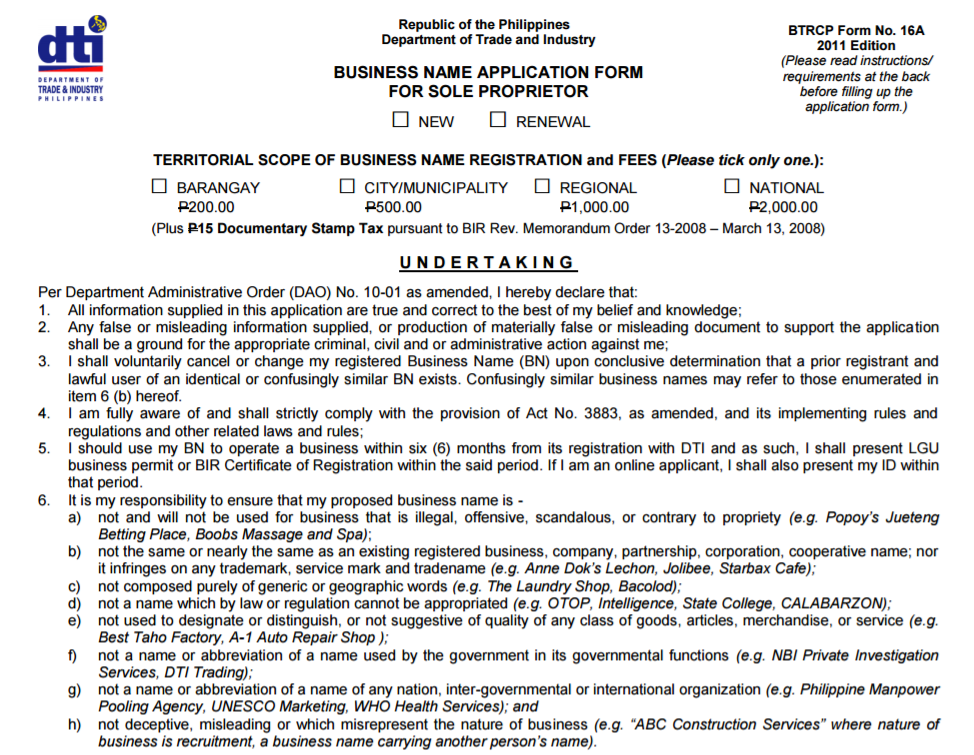

1. Register your business name at Department of Trade and Industry

a. Prepare a list of possible names of your business, in cases when your first choice is already taken.

b. Search DTI’s Business Name Search to check if business name is still available

c. If name is already taken, consider other options and try searching again

d. If name is available, fill out the Business Name Application Form for Sole Proprietor

e. Submit the filled-out Business Name Application Form for Sole Propreitor document at any DTI office near business address.

Upon successful submission and approval of application, sole proprietor will receive the DTI Certificate of Registration.

2. Register business presence at the barangay level

Proceed to the barangay where business is primarily operating or whose registered business is addressed.

a. Submit DTI Certificate of Registration obtained from the DTI.

b. Provide two valid ID cards such as drivers license, PRC license or passport

c. Proof of address such as lease contract for rented premises or certificate of land ownership. If you’re a home-based business, proof of address may include utility bills or bank statements addressed to your name and address.

Upon successful submission of these documents, applicants can claim Barangay Certificate of Business Registration.

3. Register business at Mayor’s Office

a. Proceed to city or municipal mayor’s office where business is located to secure and fill out an application form.

c. Submit completed application along with Certificate of Business Registration from DTI, two valid IDs, proof of address (same as in Barangay registration), Barangay Clearance Certificate or Community Tax Certificate (cedula), if required.

Upon complete submission of requirements, sole proprietor will obtain Mayor’s Business Permit and Licenses.

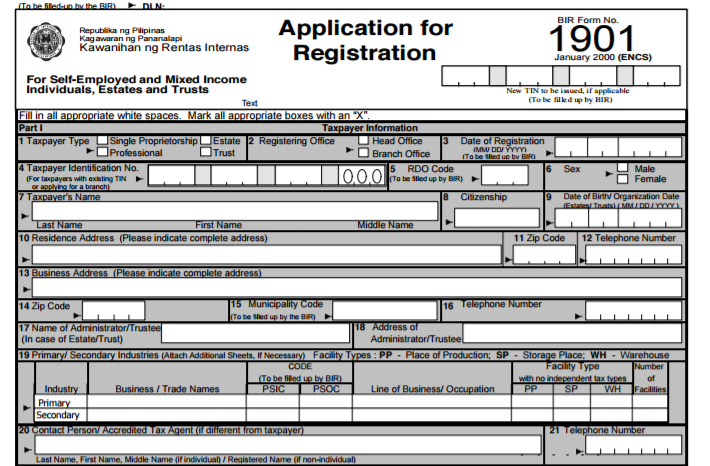

4. Register business at Bureau of Internal Revenue

With a business with future payable tax dues, business needs to register at the Bureau of Internal Revenue (BIR).

a. Visit the Regional District Office which has jurisdiction over your business location

b. Fill out the BIR Form 1901

c. Submit completed registration form together with the following documents:

- Certificate of Registration from DTI

- Barangay Clearance

- Mayor’s Business Permit

- Proof of Address

- Valid IDs

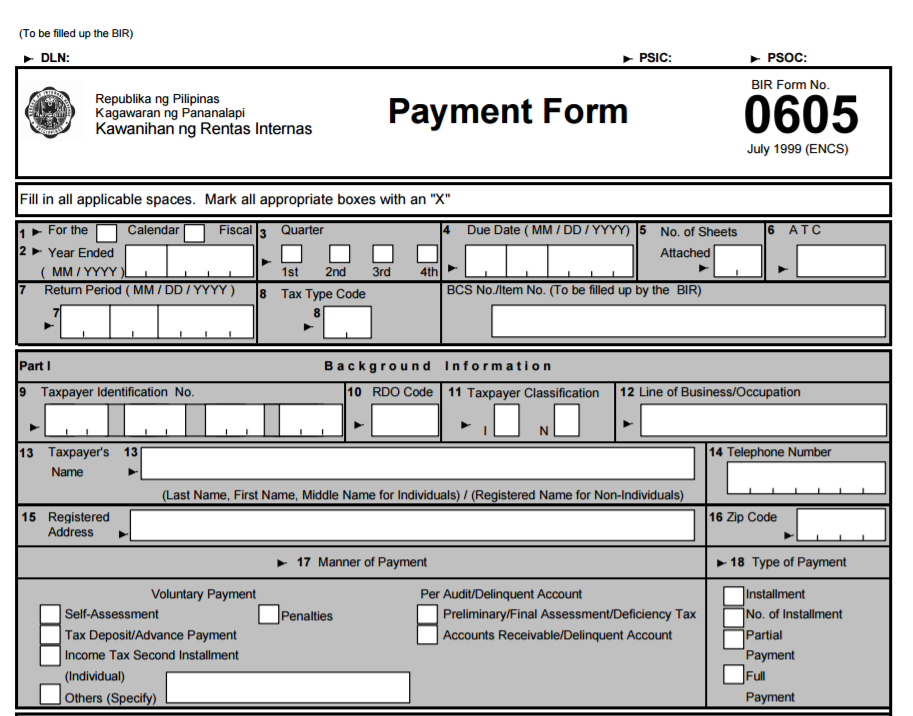

d. Pay the BIR Payment Form 0605

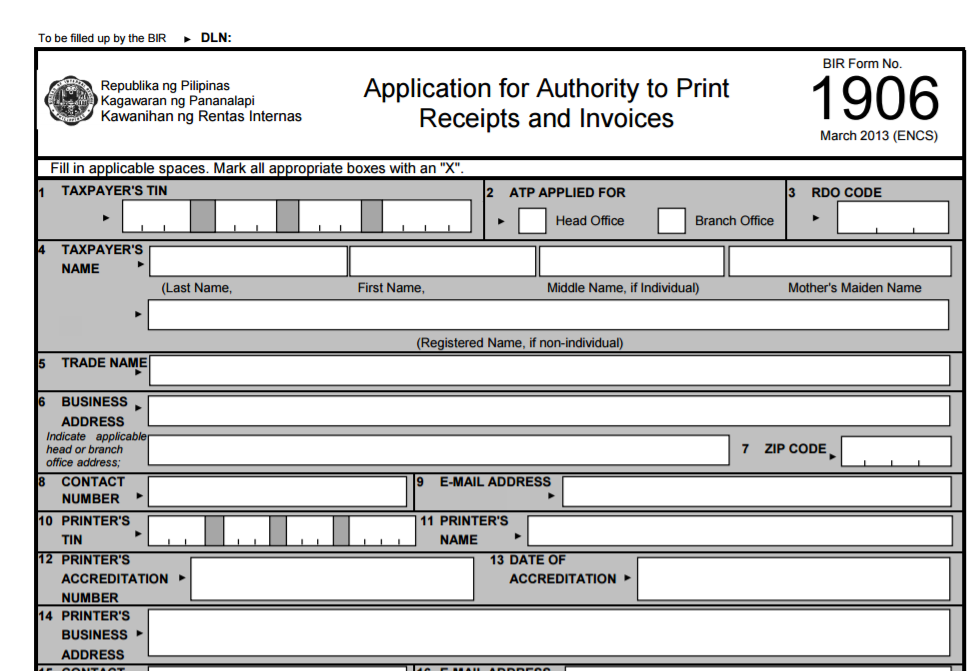

e. Apply for Certificate of Authority to Print Receipts and Invoices

Upon successful submission of above requirements, sole proprietor will receive Certificate of Registration or BIR Form 2303.

Sole proprietors can now proceed with growing the business and promote it to attract target customers.