Businesses seeking to establish presence and operations in the Philippines are required to register with government agencies. This includes local businesses initiated by Filipino citizens or foreign entrepreneurs who wish to invest in their business to target the Philippine market.

A prominent agency involved in the operation of your business in the Philippines is the Bureau of Internal Revenue or BIR. It is well-known as a tax collecting agency, but it also authorizes the business in the printing receipts, registration of TIN (Taxpayer Identification Number), and accounting books.

But before a business can officially transact with the BIR, it has to go through the Securities and Exchange Commission for company registration and seek a permit to operate with a Mayor’s Permit.

Table of Contents

Registration with Securities and Exchange Commission

Once verified, approved, and certified, a Certificate of Registration from the Securities and Exchange Commission (SEC) will be the basis of the legal existence of your company in the Philippines. By then, your company will be allowed to commence its business operations.

Registration with the SEC is available online.https://www.sec.gov.ph/online-services/sec-company-registration-system.

- Create an account using the web address https://crs.sec.gov.ph/. Verify this account using a valid email address.

- Register your new company using your SEC account by logging in at https://crs.sec.gov.ph/ and selecting Register New Company.

- Enter details such as business categories. Select ‘Other Business Activities’ under Major Industry

- Classification if your company does not fall under any of the available options.

- Enter proposed company name and suffix (Corp., Inc., etc). Please note that this field is case sensitive so whatever company name and suffix you entered will be stored as-is.

- Once the company name is validated, select the SEC office you wish your company name submission to be processed.

- Provide details of your company such as principal company address

- Review list of requirements to provide to SEC, fill out additional company details such as purpose clause, business activities and corporate information. Your entered data will be fed into a document generated automatically online and uploaded to the system upon your confirmation.

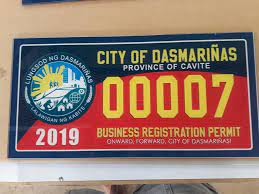

Mayor’s Permit

A Mayor’s Permit is a legal document validating a business entity’s legal operation in a local government unit. Depending on your location of business operation, requirements may vary.

In general, the requirements for obtaining a Mayor’s Permit for businesses in the Philippines are the following:

- Application Form

- Certificate of Registration from Securities and Exchange Commission (SEC) for Corporations/Partnerships;

- Department of Trade and Industry (DTI) for Sole Proprietorships; or Cooperative Development Authority (CDA) for Cooperatives

- Barangay Business Clearance

- Community Tax Certificate (CTC or Cedula)

- Contract of Lease (if leased)/Transfer Certificate of Title (if owned)

- Sketch/Pictures of the business location (3 copies)

- Public Liability Insurance (for Restaurants, Cinemas, Malls, etc./exempted: Sari-sari Stores, Carinderias)

- Locational/Zoning Clearance

- Certificate of Occupancy (Building and Unit)

- Building Permit and Electrical Inspection Certificate

- Sanitary Permit

- Fire Safety Inspection Permit

BIR Registration Philippines: Certificate of Registration

The Bureau of Internal Revenue is the national government regulatory agency that regulates finance, taxation, and monetary policy in the Philippines. As businesses are subject to taxation, registration of companies with the BIR is necessary. A Certificate of Registration from the Bureau of Internal Revenue (BIR) to enable the agency the enforcement of tax collection, penalties/fines (if any), and other relevant matters.

The Certificate of Registration issued by BIR (BIR Form 2303) contains an enumeration of the types of taxes that are required to be paid to the government, which includes the following:

- Corporate income tax

- Value-added tax

- Withholding taxes (on compensation, fringe benefits, etc.)

Registering your business with the BIR gives your company the authority to

- Print your official receipts and invoices,

- Register the Tax Identification Number (TIN) provided for your company in the Certificate of Registration issued by SEC

- Register the books of accounts you are required to annually register with BIR to serve as the official record of your business transactions for the fiscal year.

How to Register Your Business with BIR

- Accomplish BIR Form 1903 (Application for Registration for Corporations/Partnerships (Taxable/Non-Taxable)) and submit the same together with the required supporting documents to the Revenue District Office (RDO) that has jurisdiction over the registered address of your business establishment. The supporting documents to be attached to Form 1903 are as follows:

- SEC Certificate of Registration (Certificate of Incorporation for domestic corporations/License to Do Business in the Philippines for resident foreign corporations)

- Mayor’s Permit or application for Mayor’s Permit (must be submitted prior to the issuance of the BIR Certificate of Registration)

- Contract of LeaseOther documents to be submitted, if applicable:

– Certificate of Authority (if Barangay Micro Business Enterprises (BMBE) registered entity)

– Franchise Agreement

– Proof of Registration/Permit to Operate with BOI, PEZA, SBMA or BCDA

- Pay the Annual Registration Fee (P500) at the Authorized Agent Banks (AABs) of the concerned RDO

- Pay the Documentary Stamp Tax (DST) on Subscription and Lease (BIR Form 2000). The DST on Subscription depends on the amount of your capital while the DST on Lease depends on your monthly rental.

After receipt of the aforementioned requirements, the BIR staff will get back to you to inform you when the BIR Certificate of Registration (Form 2303) is going to be available.

After securing a BIR Certificate of Registration, the business will be required to do the following:

- Apply for Sales Invoices/Official Receipts through BIR Form 1906 – Authority to Print Receipts and Invoices. The documentary requirements for obtaining such are as follows:

- BIR Form 1906 (Authority to Print)

- BIR Certificate of Registration (Form 2303)

- Final and clear sample of Principal and Supplementary Commercial Receipts and Invoices

- BIR Certificate of Registration of Accredited Printer

- BIR Annual Registration Fee (Form 0605) of Accredited Printer

- Job order

- Quarterly report of Accredited Printer

- Register books of accounts and have them stamped by the RDO where your business is registered. Note that the BIR examiner will usually advise you the types of books and taxes applicable to your business upon the initial taxpayer’s briefing. The documentary requirements you have to submit upon registering your books of accounts are the following:

- BIR Certificate of Registration (Form 2303)

- New sets of books of accounts, such as but not limited to:

- General Journal

- General Ledger

- Cash Receipt

- Cash Disbursement

- Subsidiary Sales Journal

- Subsidiary Purchase Journal

- Attend the taxpayer’s initial briefing to be conducted by the RDO for new registrants to inform them of their rights and duties/responsibilities

Additional notes:

- An “Ask for Receipt” Notice, a reminder for customers to ask for a receipt in every transaction with your company, will be issued together with the BIR Certificate of Registration and you must display both documents prominently in your business establishment.

- Your corporation, as well as its branches, must accomplish and file the application on or before you commence business operations.

- The business is required to pay the Documentary Stamp Tax (DST) on the Articles of Incorporation (AOI) on the 5th of the month following the date of issuance of the AOI (as prescribed under Section 175 of the National Internal Revenue Code of 1997).

- If the DST is required to be paid within five days after the close of the month, BIR Registration shall be done on or before payment of DST due.

- Once your BIR Certificate of Registration is issued to you, you are given 30 days to have your official receipts and sales invoices printed.