The health benefits of employees of Philippine businesses are typically covered by the government’s PhilHealth program. Such services provide basic to intermediate assistance on hospitalization, medicines, and other forms of health needs.

Under the guidelines of the Philippine Health Insurance Corporation, an updated PhilHealth Contribution for members who are employed in the Philippines, overseas Filipino workers, self-employed or individually paying members. As a yearly payment to retain membership and avail of health benefits, it is important for PhilHealth members to be aware of the new guidelines such as coverage of benefits for members and dependents, and premiums that every member has to pay.

Table of Contents

Overview

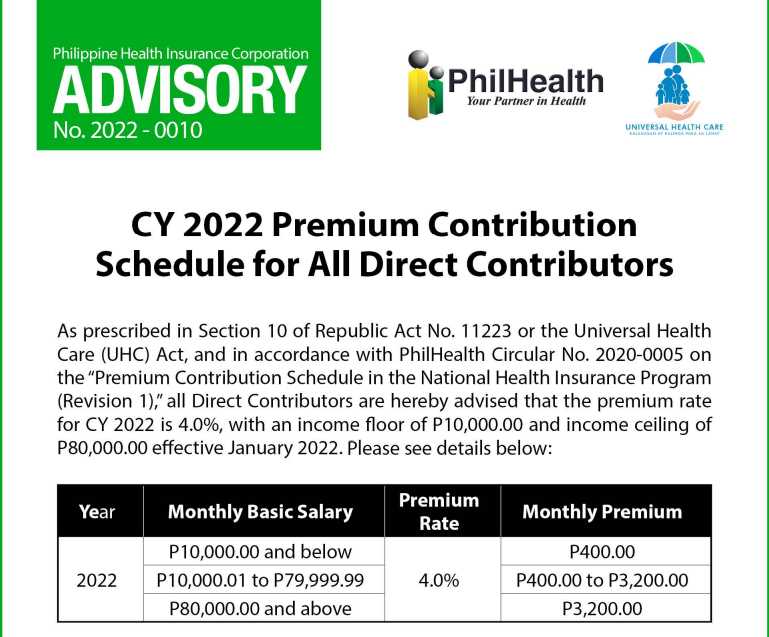

In January 2022, as prescribed in Section 10 of Republic Act No. 11223 or the Universal Health Care (UHC) Act, and in accordance with PhilHealth Circular No. 2020-0005 on the “Premium Contribution Schedule in the National Health Insurance Program

(Revision 1 );’ all Direct Contributors are hereby advised that the premium rate

for CY 2022 is 4.0%, with an income floor of P10,000 and an income ceiling of

P80,000 effective January 2022.

The adjusted premium rate shall take effect in the Electronic Premium

Remittance System (EPRS) and the PhilHealth Member Portal starting the

applicable month of June 2022. Members and employers who have already paid

their contributions at 3% are advised to generate the corresponding Statement

of Premium Account for the paid periods so they can settle the 1 o/o differential

payments/remittances until December 31, 2022.

| Monthly Basic Salary x2.75% | Monthly Premium | Member's Share | Employer's Share |

|---|---|---|---|

| P10,000 and below | P275 | P137.5 | P137.5 |

| P10,000 to P39,999.99 | P275.02 to P1,099.99 | P137.51 to P549.99 | P137.51 to P549.99 |

| P40,000 and above | P1,100 | P550 | P550 |

Premium contributions of lower-income workers such as household service workers are covered by their employers, according to RA 10361. However, if a domestic worker is receiving a salary of P5,000 or higher, then he or she shall contribute to the fund proportionally.

If your monthly salary is P20,000, here’s how to compute your 4% (or 0.04 in decimals).

P20,000 x 0.04 = P800.

Your total contribution is P800. But since your employer will shoulder half of the contribution, you only need to contribute P400 as a PhilHealth member. With that amount, you are already covered by inpatient, outpatient, and Z benefits and treatment packages.

Further inquiries may be referred to the PhilHealth Action Center at Callback

Channel: 0917-898-7442 (PHIC) or through email at actioncenter@philhealth.

gov.ph. Please visit https://www.philhealth.gov.ph for additional information.

PhilHealth Contribution to overseas Filipino workers

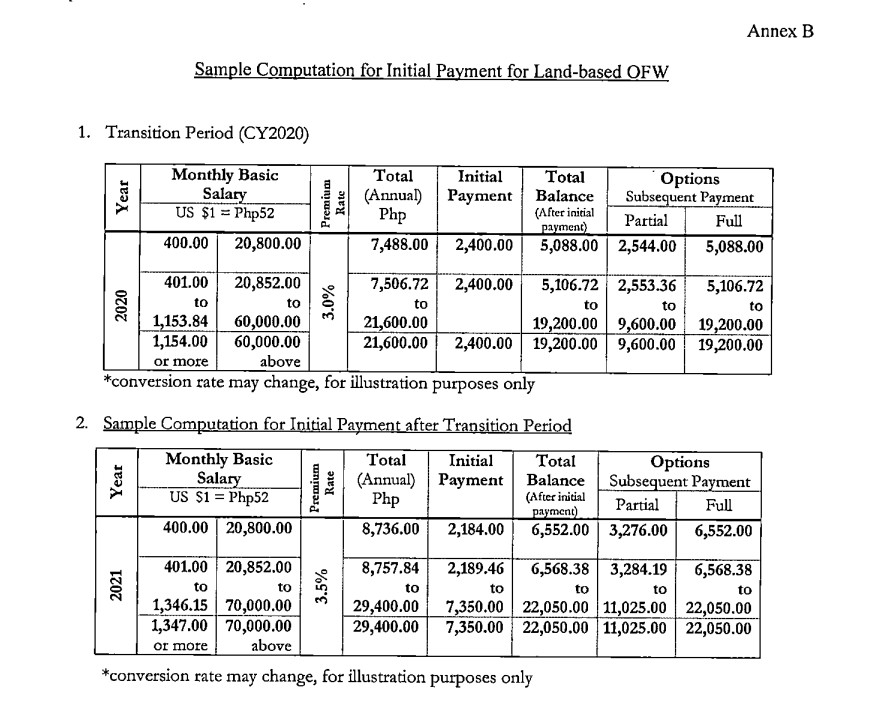

Overseas Filipinos who are PhilHealth members pay a premium based on their income. Premiums can be paid in advance for two years to five years or depending on the duration of the employment contract with the overseas employer.

| Year | Premium Rate | Income Floor | Income Ceiling |

|---|---|---|---|

| 2019 | 2.75% | P10,000 | P50,000 |

| 2020 | 3.0% | P10,000 | P60,000 |

| 2021 | 3.5% | P10,000 | P70,000 |

| 2022 | 4.0% | P10,000 | P80,000 |

| 2023 | 4.5% | P10,000 | P90,000 |

| 2024 | 5.0% | P10,000 | P100,000 |

| 2025 | 5.0% | P10,000 | P100,000 |

In 2022, the premium rate is 4% which means if your monthly income is $400 (or P22,000), your monthly PhilHealth contribution will be P880 or P10,560 per year. After an initial payment of P2,400, your remaining balance can be paid in full, or in quarterly installment payments.

PhilHealth contribution for self-employed members

Self-employed and freelance workers are can take comfort knowing that even without employers, they are covered with health insurance normally accorded to full-time employees.

- For those earning P25,000 or below in a month, your premium is P2,400 a year.

- For those earning more than P25,000, you have to pay P3,600 annually.

- Payment can be made quarterly, bi-annually, or annually.

PhilHealth Contribution for Sponsored Program Members

Sponsored members of PhilHealth are those who do not fall under the previous categories such as those under the lower income bracket, orphans and abandoned people, senior citizens and abuse victims under the care of DSWD, or barangay health workers, tanods and other similar workers covered under their own local government units.

Annual premium of P2,400 is also applied to these types of members.

Conclusion

To many members, PhilHealth premium payment is another part of the ongoing expense that will eat up the household budget. This is on top of the budget allocated for food, transportation, utilities, and other household expenses.

Despite the hike in PhilHealth premium, such cost — just a fraction of your monthly income — is nothing compared to the exorbitant fees on medical bills you need to settle if you are not covered by PhilHealth benefits. That is why it makes a lot of sense to check your contributions regularly and pay them on time. Missing on paying your premium could forfeit your health benefits.

If you think you are healthy enough, with proper diet, sleep, and exercise, your dependent may suddenly fall ill and need medical attention. So paying your regular contribution is not just for your medical coverage, but for your children, spouse, or parents who may need medical attention more than you do.