Are you unsure if your employer is honestly and religiously honoring their obligation of remitting your Pag-IBIG, PhilHealth or SSS contributions withheld from your salary every month? We do hope employers are trustworthy and comply with the responsibilities entrusted to them, but what if they aren’t?

If you are uncertain about the remittance payment paid regularly by employers, then it’s about time you verify it. Without the need for reminders, employers are required by law to remit their employees’ contribution payments on a monthly or quarterly basis. It should be noted that even when your payslip shows SSS and other mandatory contributions are being deducted, it is not a guarantee that employers will do the corresponding remittance.

Table of Contents

Why employers skip paying SSS, Pag-IBIG, PhilHealth payments

Some employers refuse to comply with the law and violate the enforcement of SSS laws. Part of this group simply wish to contribute their counterpart fund, looking at it as extra financial burden, even if such small increment in expense means a lot in securing health and pension benefits for employees.

That is why workers must exert effort in finding out whether they are properly compensated according to law. Failure or refusal of employers to pay contributions on a regular basis could deprive workers of eligibility for benefits such as salary or housing loans. Another possible consequence is delay in receiving such benefits such as PhilHealth assistance when you are hospitalized.

Penalty for failure to remit contributions

Under Social Security Law, offending employers are subject to fine of up to P20,000 (yes, it is very low) and prison terms of six years or more.

Check your Pag-IBIG, PhilHealth, and SSS contributions regularly. Yours should be up-to-date and remitted correctly, so you can qualify for housing and salary loans from SSS or Pag-IBIG anytime you need to borrow money for your short-term needs. This will also prevent delays in processing of your health/retirement benefits or salary, housing and other loans.

How to check your Pag-IBIG contributions

There are several ways a Pag-IBIG member can verify his or her contributions, and whether or not they have been paid on time.

- Pag-IBIG Hotline: +63 2 724-4244 (open 24/7)

- Email: contactus@pagibigfund.gov.ph

- Pag-IBIG Chat support

- Pag-IBIG Fund Facebook page

- Personal inquiry at the nearest Pag-IBIG branch

Regardless of what Pag-IBIG contribution verification method you use, you’ll need to provide the following personal information:

- Full name

- Birthdate

- Name of your past and present employers

(We think that this verification information should be tightened since this information is easily obtainable; anyone who knows your full name, birth date and past or present employer will be able to call the hotline and make enquiries even if you don’t authorize them to do so.)

How to check your PhilHealth contributions

There are two ways to check your PhilHealth contributions, whether they are paid in full amount or in a timely fashion:

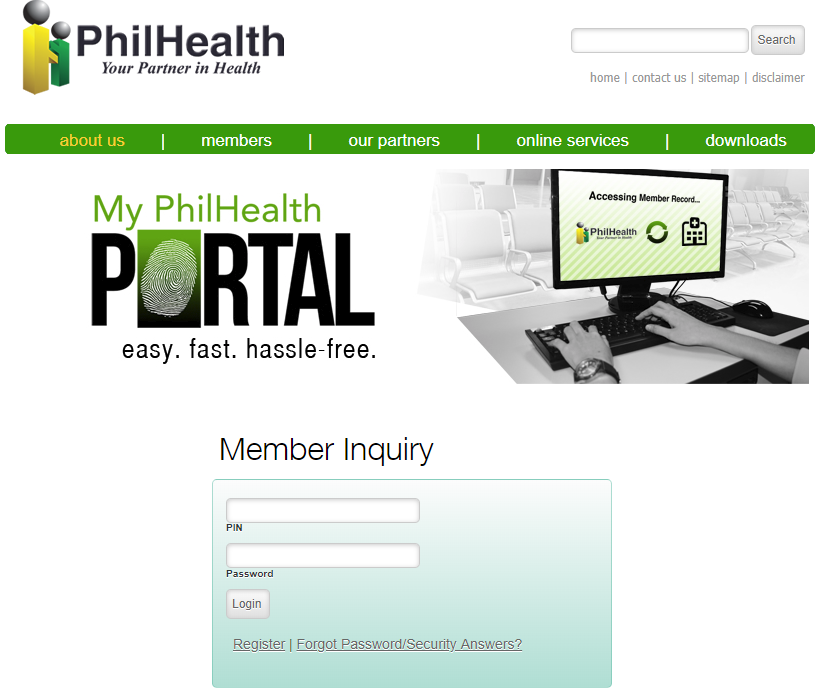

1. Member Inquiry Facility

This option requires a member to sign up for an account. If you haven’t done so, go to the online registration page (you should have already registered as PhilHealth member to get this account). Upon verification of your account online, as a member you can now check your PhilHealth contributions by logging in.

Upon successful login, system will display Member Static Information page. Click on Premium Contributions below the table that shows your personal details.

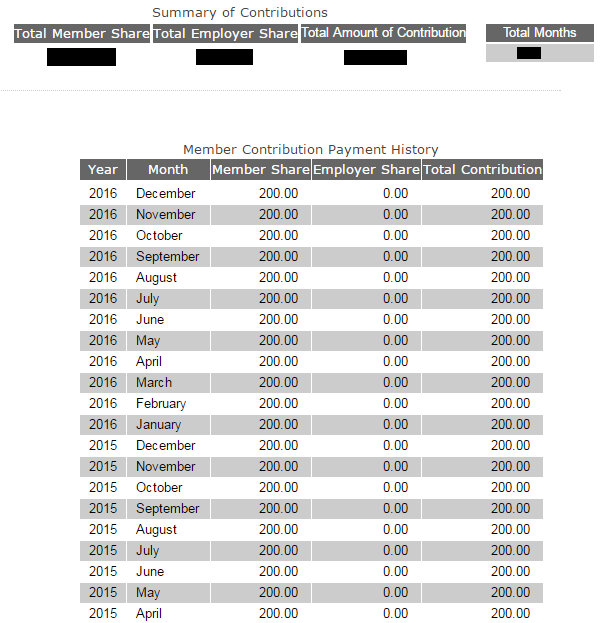

The Premium Contribution page shows the following information related to your PhilHealth contributions:

- Summary of contributions. This table shows your total contribution and the total number of monthly payments.

- Member contribution payment history. This table shows all your monthly contributions since you started paying your PhilHealth contributions. If you are self-employed, employer share is 0 as shown in example below but if you are employed, that column should reflect on whether your company has contributed to your PhilHealth contribution or not.

2. Interactive Voice Response System

You can also dial PhilHealth’s hotline linked to an interactive voice response system to inquire your contributions, follow up on membership, benefits and other related questions you may have.

How to check your PhilHealth contributions using the IVRS:

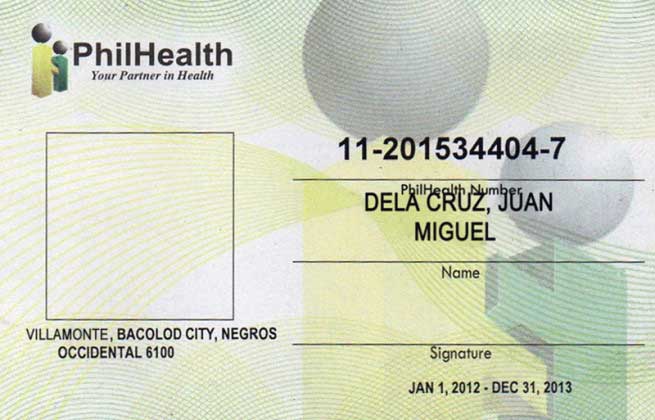

1. Prepare your PhilHealth Identification Number. You can find this number within your PhilHealth ID card.

2. Dial (02) 441-7442 and follow the instructions from the voice prompt.

How to check your SSS contributions

1. Online via the My.SSS

Just like PhilHealth, you can check your SSS contribution online through the My.SSS facility. As a member of SSS (even if you are not currently active in your contribution), you are eligible to register for a My.SSS account.

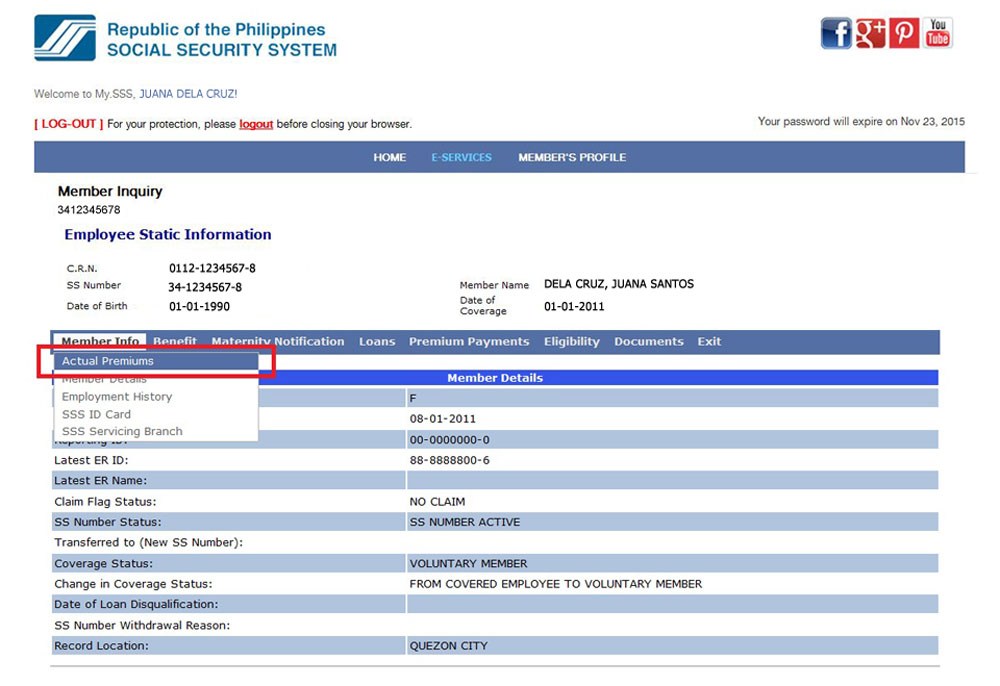

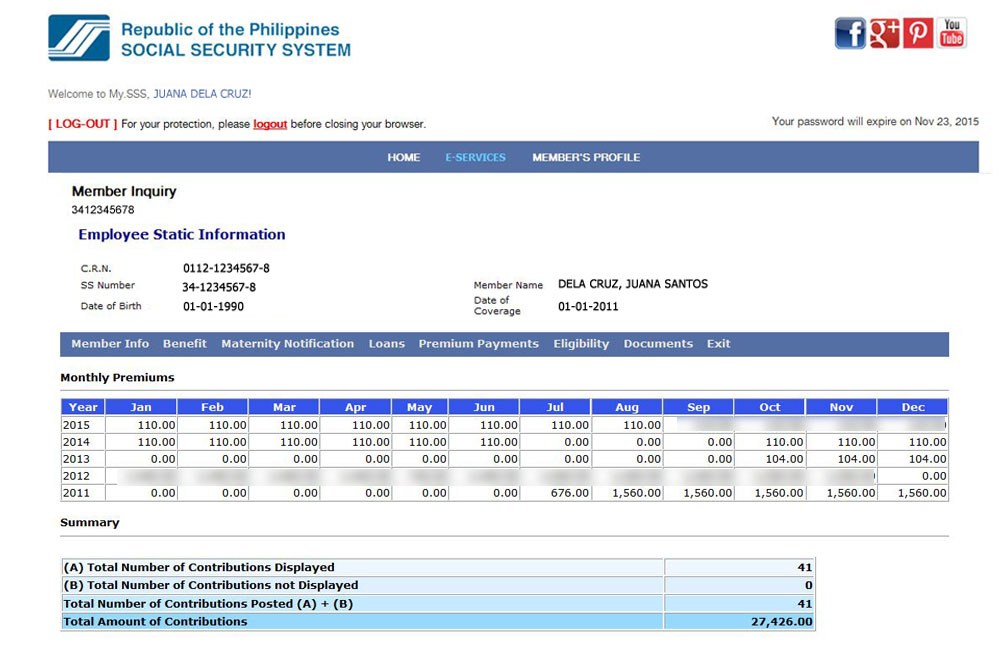

- Log in to your My.SSS account by entering your user ID and password.

- Look for the E-SERVICES link on the top menu. Under it, click on Inquiry. This will take you to the Member Inquiry page, where Actual Premiums is found under Member Info.

A summary of your yearly/monthly premium contributions since the beginning of your contributions until the current month will be displayed.

2. SMS via the SSS mobile text facility

You can make inquiries about SSS using the SSS Text Service. This provides information not only on your contribution but also on loans, maternity notification and others.

First you need to register to avail of this service.

To register, text SSS REG <SS Number> <Date of Birth in MM/DD/YY Format>

Example: SSS REG 021234567 12/21/90

Then send to 2600 for Globe, Smart and Sun Cellular subscribers. Your cellular may charge for the SMS you’ll send.

Wait for a response from 2600 containing your SSS PIN, which will be used to validate your identity in future SMS transactions with SSS.

To check how much is your SSS Contribution, text SSS CONTRIB <SS Number> <PIN> then send to 2600.

Example: SSS CONTRIB 021234567 2266

While we are at this topic, you may also avail the SSS Text Service for the following inquiries and notifications:

| Service | SMS Text (to 2600) |

|---|---|

| Maternity notification | SSS MATERNITYNOTIF |

| Loan status | SSS LOANSTAT |

| Loan balance | SSS LOANBAL |

| Sickness benefit | SSS STATUS Sickness |

| Disability benefit | SSS STATUS Disability |

| Maternity benefit | SSS STATUS Maternity |

| Retirement benefit | SSS Status Retirement |

| Funeral benefit | SSS STATUS Funeral |

| Death benefit | SSS STATUS Death |

This service, however, will only display your contribution value and will not provide breakdown of contribution history — hence you won’t be able to determine if your employer has made a contribution over the recent months.

3. Personal inquiry at SSS offices

If you have time and when the two options above don’t seem to work, you can verify your contributions at the SSS main office at East Avenue, Quezon City. To avoid the long queues, set an appointment online using My.SSS. For provincial SSS members, please check the listings of SSS offices near your location.

Conclusion

Checking your Pag-IBIG, PhilHealth and SSS contributions is a favor you do for future. While you are still an active contributor as a current employee, you might find out that there are periods (months or years) of premium payment gaps. It will then be easier to verify with your employer to make payments for unpaid contributions.

Under the SSS law, it is unlawful for private employers in the Philippines to fail or refuse to remit to their employees’ SSS contributions via appropriate salary deductions. Although your payslip may indicate a deduction was made for your SSS contribution, your employee might failed to remit it to the SSS.

Therefore, doing this due diligence will ultimately benefit SSS members.