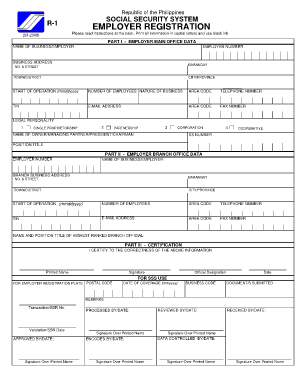

Any person who uses the services of another person in business, trade, industry or any undertaking or social, civic, professional, charitable and other non-profit organizations who hire the services of employees are classified as employers.

As employers, they have duties and responsibilities to their employees besides complying with labor and Philippine laws such as prompt payment of salaries, withholding taxes and granting paid vacations and bonuses.

As employers of members who are registered with SSS, these are their primary responsibilities.

- Require the presentation of the SS number of a prospective employee;

- Report all employees for SS coverage within thirty (30) days from the date of employment by submitting an accomplished Employment Report (SS Form R-1A) at the SSS servicing branch;

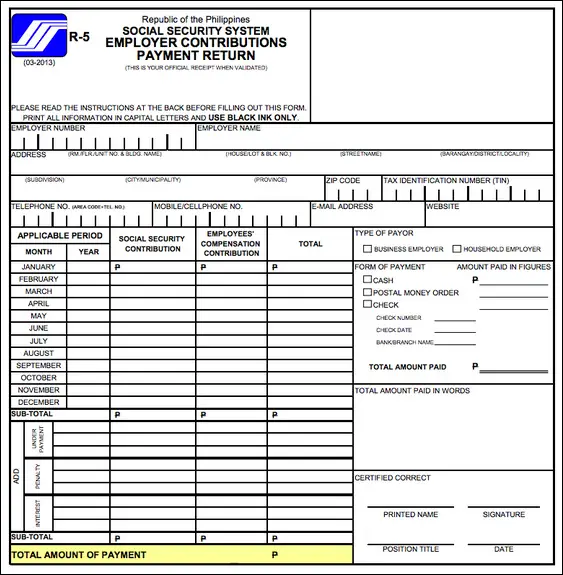

- Deduct from the employees the monthly SS contributions based on the schedule of contributions; pay his share of contributions including Employees’ Compensation (EC) and remit these contributions to the SSS with tellering facilities or accredited banks within the first ten (10) calendar days following the month when said contributions are due and applicable;

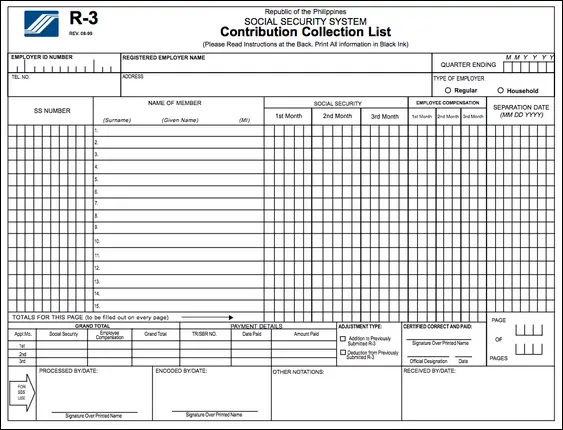

- Submit a summary of all employees’ contributions thru Contribution Collection List (SS Form R-3) together with a copy of the Special Bank Receipt (SBR) and Contributions Payment Return (SS Form R-5) within 10 days after the applicable quarter;

An employer may also participate in the SSSNet, a computer service using the electronic data interchange technology, designed to hasten the posting of employees’ contributions for faster processing and availment of benefits and loan privileges.Or, the employer may opt to participate in the R3 Diskette Project which allows the submission of the monthly summary of employees’ contribution thru a diskette or flash disk. This system is a better alternative to manual reporting as it minimizes encoding errors and processing time. - Issue official receipts and maintain official records of employment and deductions for all contributions deducted from the employees’ pay envelopes;

- Remit to the SSS all salary, educational, stocks investment or privatization loan amortization of his employees and submit an accomplished Monthly Salary/Calamity/Emergency/Stock Investment Loan Payment Return (SS Form ML-1) to any of the SSS accredited banks within the first ten (10) calendar days following the month when said amortizations are due and applicable;

- Submit a summary of all employees’ loan amortization thru an accomplished Collection List (SS Form ML-2) with copies of the SBRs and SS Form ML-1 on or before the tenth day following the applicable month to the SSS servicing branch;An employer may also participate in the Salary Loan Repayment Diskette project which allows the submission of the monthly summary of employees’ loan repayment thru diskette, CD, flash disk or DVD. This system provides an employer with convenience and hastens the posting of member’s loan repayments.

- Advance SS and EC sickness benefits due to his/her employees once these are approved by the SSS;

- Advance SS maternity benefits due to qualified female employees;

- File for reimbursement for all legally advanced sickness and maternity benefits;

- Keep his/her employees updated on the changes in SSS policies and increases in their benefits;

- Ensure that all forms submitted are properly and accurately accomplished;

- Inform SSS of any change in company address, business name or temporary/permanent cessation of business operations through the submission of a duly notarized Employer Data Change Request (SS Form R- 8);

- Submit an updated Specimen Signature Card (SS Form L-501) annually; and

- Certify SSS-related documents for the employees when required for purposes of their claims